Contents

- Understanding the Importance of Insurance for Appliance Repair Businesses

- Types of Insurance Coverage for Appliance Repair Businesses

- General Liability Insurance: Protecting Against Third-Party Claims

- Property Insurance: Safeguarding Your Business Assets

- Professional Liability Insurance: Protecting Against Errors and Omissions

- Workers’ Compensation Insurance: Ensuring Employee Protection

- Business Interruption Insurance: Minimizing Financial Losses

- Commercial Auto Insurance: Protecting Your Vehicles

- Equipment Breakdown Insurance: Safeguarding Against Equipment Failures

- Conclusion: Protecting Your Appliance Repair Business with Comprehensive Insurance

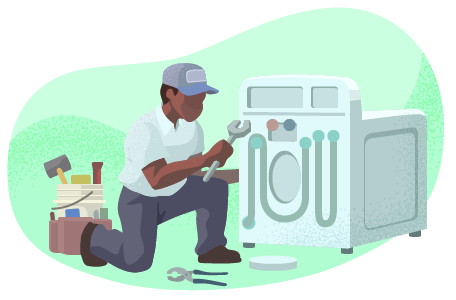

Running an appliance repair business can be both rewarding and challenging. As a business owner, you are responsible for not only providing top-quality repair services but also ensuring the safety of your employees and customers. That’s why it is imperative to protect your appliance repair business with comprehensive insurance. With appliance repair business insurance, you can safeguard your business from unexpected financial losses, liability claims, and damages. Whether it’s protecting your valuable equipment, covering medical expenses in case of accidents, or defending against lawsuits, comprehensive insurance provides the peace of mind you need to focus on what you do best – keeping appliances running smoothly.

Understanding the Importance of Insurance for Appliance Repair Businesses

Appliance repair businesses play a crucial role in keeping our daily lives running smoothly. As an owner or operator of such a business, you understand the importance of providing reliable service and ensuring customer satisfaction. However, it is equally important to protect your business from unforeseen risks and potential liabilities. This is where insurance comes in.

Why Appliance Repair Businesses Need Insurance

Appliance repair businesses face a unique set of challenges and risks that can have a significant impact on their operations and financial stability. From accidental property damage to bodily injury claims, the potential for lawsuits and financial losses is ever-present. Without proper insurance coverage, these risks can put your business at great risk.

Types of Risks Faced by Appliance Repair Businesses

Appliance repair businesses are exposed to several types of risks on a daily basis. One of the most common risks is accidental damage to customers’ property while performing repairs or installations. Additionally, there is a risk of bodily injury to customers or employees, which can occur due to equipment malfunction or accidents on the job. Other potential risks include errors or negligence in professional assessments and recommendations, as well as damage or theft of business property.

Key Benefits of Having Comprehensive Insurance

Comprehensive insurance coverage provides a safety net for your appliance repair business, offering a range of benefits that can help mitigate financial losses and protect your business assets. Some of the key benefits of having comprehensive insurance include:

-

Financial Protection: Insurance coverage can provide financial support in the event of unexpected accidents, damages, or lawsuits, ensuring that your business can continue to operate without bearing the full financial burden.

-

Legal Protection: Insurance policies often include coverage for legal expenses, ensuring that you have the necessary resources to defend your business against claims or lawsuits.

-

Peace of Mind: Knowing that your business is protected against unforeseen events can give you peace of mind, allowing you to focus on providing quality service to your customers.

-

Customer Trust: Having comprehensive insurance coverage demonstrates to your customers that you take their satisfaction and safety seriously. This can help build trust and loyalty, giving your business a competitive edge.

-

Compliance with Legal Requirements: Depending on your jurisdiction, certain types of insurance, such as workers’ compensation insurance, may be legally required. Having the necessary insurance coverage ensures that your business complies with these regulations.

Types of Insurance Coverage for Appliance Repair Businesses

To adequately protect your appliance repair business, it is essential to understand the different types of insurance coverage available to you. Here are the main types of insurance coverage that you should consider:

General Liability Insurance

General liability insurance is a fundamental coverage for any business, including appliance repair businesses. It provides protection against third-party claims for bodily injury, property damage, personal injury, and advertising injury. This coverage is crucial in case a customer or a member of the public suffers an injury or their property gets damaged while your business is performing repairs or installations.

Property Insurance

Property insurance covers the building and contents of your appliance repair business against damage or loss due to fire, theft, vandalism, or natural disasters. This insurance ensures that your business assets, such as tools, equipment, and inventory, are protected in case of unforeseen events.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is particularly important for appliance repair businesses. It provides coverage for claims arising from professional mistakes, errors, or negligence in providing repair or installation services. This insurance safeguards your business from potential lawsuits related to faulty workmanship, improper repairs, or inadequate recommendations.

Workers’ Compensation Insurance

Workers’ compensation insurance is critical for protecting your employees in the event of work-related injuries or illnesses. It provides coverage for medical expenses, rehabilitation costs, and lost wages, ensuring that your employees receive the necessary support and financial assistance during their recovery. It also helps protect your business from potential legal liabilities and penalties related to workplace accidents.

Business Interruption Insurance

Business interruption insurance is designed to address the financial impact of unexpected events that disrupt your normal business operations. It provides coverage for loss of income and operating expenses during the period of interruption, allowing your business to recover and resume operations without suffering a major financial setback. This insurance is particularly valuable in situations where your business is unable to operate due to property damage or other covered perils.

Commercial Auto Insurance

If your appliance repair business involves the use of vehicles for transporting equipment or traveling to customer locations, commercial auto insurance is essential. This type of insurance provides coverage for your business vehicles, protecting them from accidents, damages, and theft. It also offers liability coverage in case your employees are involved in an accident while driving company vehicles.

Equipment Breakdown Insurance

Appliance repair businesses heavily rely on specialized equipment and tools to perform repairs and installations. Equipment breakdown insurance provides coverage for the repair or replacement of such equipment in case of mechanical or electrical breakdowns. It also offers protection against financial losses and business interruptions caused by equipment failures, helping you minimize downtime and maintain your operations smoothly.

General Liability Insurance: Protecting Against Third-Party Claims

General liability insurance is a critical coverage for appliance repair businesses as it protects against third-party claims for bodily injury, property damage, personal injury, and advertising injury. Here are some key aspects of general liability insurance:

Coverage for Bodily Injury and Property Damage

General liability insurance provides coverage for any bodily injury or property damage that occurs during the course of your business operations. For example, if a customer accidentally injures themselves on your premises or if your technician accidentally damages a customer’s property while performing repairs, general liability insurance can help cover the associated costs.

Protection Against Personal and Advertising Injury

In addition to bodily injury and property damage, general liability insurance also provides protection against personal and advertising injury. This includes coverage for claims of defamation, slander, or copyright infringement caused by your business’s advertising or promotional activities.

Importance of General Liability Insurance for Appliance Repair Businesses

Appliance repair businesses are inherently exposed to various risks that can lead to costly lawsuits and financial losses. Having general liability insurance ensures that you are financially protected in the event of accidents or damages caused to third parties. It allows you to focus on providing quality service to your customers without constantly worrying about potential liabilities.

Property Insurance: Safeguarding Your Business Assets

Property insurance is a vital coverage for appliance repair businesses as it protects your building and contents against a range of perils. Here are some important aspects of property insurance:

Coverage for Building and Contents

Property insurance provides coverage for physical damage or loss to your appliance repair business’s building and contents. This includes both owned and leased properties, protecting your assets from perils such as fire, theft, vandalism, and natural disasters.

Protection Against Fire, Theft, Vandalism, and Natural Disasters

Property insurance safeguards your business assets against the financial impact of various perils. In the case of fire, for example, property insurance can help cover the costs of repairing or rebuilding your business premises. It also provides coverage for stolen equipment or inventory and damage caused by vandalism or natural disasters like storms or earthquakes.

Additional Coverage Options

Depending on your business’s specific needs, you may have the option to add additional coverage to your property insurance policy. This can include coverage for equipment breakdown, spoilage of perishable goods, or coverage for off-premises property. Discussing your unique requirements with an insurance professional can help you determine the most suitable coverage options for your appliance repair business.

Importance of Property Insurance for Appliance Repair Businesses

As an appliance repair business, your tools, equipment, and inventory are essential to your daily operations. Property insurance provides the necessary protection to ensure that your business can quickly recover from unexpected events and continue serving your customers. It offers peace of mind knowing that your assets are safeguarded, allowing you to focus on delivering quality service without worrying about potential financial losses.

Professional Liability Insurance: Protecting Against Errors and Omissions

Professional liability insurance, also known as errors and omissions insurance, is a crucial coverage for appliance repair businesses. Here are some key aspects of professional liability insurance:

Coverage for Professional Mistakes and Negligence

Professional liability insurance provides coverage for claims arising from professional mistakes, errors, or negligence in your appliance repair services. This can include situations where your repairs are not performed correctly, resulting in further damage to an appliance or property. If a customer suffers financial losses due to your professional advice or recommendations, professional liability insurance can help cover the costs associated with resolving the issue.

Claims and Legal Expenses

In the event of a claim or lawsuit, professional liability insurance covers the legal expenses associated with defending your business. It also offers coverage for settlements or judgments if you are found liable for damages caused by professional errors or omissions. This can be a significant financial relief, as legal costs and settlements can quickly escalate.

Importance of Professional Liability Insurance for Appliance Repair Businesses

Appliance repair businesses are responsible for ensuring that appliances are repaired or installed correctly, as well as providing accurate recommendations and advice to customers. However, mistakes and errors can happen, and the consequences can be costly. Professional liability insurance provides essential protection against potential lawsuits and financial losses, allowing you to focus on providing reliable and high-quality service to your customers.

Workers’ Compensation Insurance: Ensuring Employee Protection

Workers’ compensation insurance is a crucial coverage for appliance repair businesses to protect both employees and employers in case of workplace injuries or illnesses. Here are some important aspects of workers’ compensation insurance:

Coverage for Workplace Injuries and Illnesses

Workers’ compensation insurance provides coverage for medical expenses, rehabilitation costs, and lost wages for employees who suffer work-related injuries or illnesses. This includes injuries sustained while performing repairs or installations or any other work-related activity. It ensures that your employees receive the necessary financial support and medical care while recovering from their injuries or illnesses.

Legal Requirements and Penalties

In many jurisdictions, workers’ compensation insurance is a legal requirement for businesses that employ workers. Failing to provide the mandated coverage can result in significant penalties and legal liabilities for your appliance repair business. It is essential to understand the specific workers’ compensation insurance requirements in your jurisdiction and ensure compliance to protect both your employees and your business.

Importance of Workers’ Compensation Insurance for Appliance Repair Businesses

Appliance repair work often involves handling heavy equipment and working in potentially hazardous environments. Accidents and injuries can occur despite your best efforts to maintain a safe workplace. Workers’ compensation insurance ensures that your employees are protected and receive the necessary support during the recovery process. It also safeguards your business from potential legal liabilities and financial penalties associated with workplace accidents.

Business Interruption Insurance: Minimizing Financial Losses

Business interruption insurance is a vital coverage for appliance repair businesses, particularly in the event of unexpected disruptions to your operations. Here are some important aspects of business interruption insurance:

Coverage for Loss of Income and Operating Expenses

Business interruption insurance provides coverage for the loss of income and ongoing operating expenses during a period of interruption caused by a covered event. This includes situations where your business is temporarily unable to operate due to property damage, such as fire, water damage, or other covered perils. The insurance compensates for the financial losses you incur as a result of the interruption.

Protection Against Unexpected Events

Appliance repair businesses can face unforeseen events that temporarily halt operations, resulting in significant financial strain. For example, a fire in your office or workshop could render your equipment unusable or cause damage that requires extensive repairs. Business interruption insurance helps cover the financial impact of such events and enables you to stay afloat during difficult times.

Importance of Business Interruption Insurance for Appliance Repair Businesses

Business interruption insurance is crucial for appliance repair businesses as it provides financial stability when unexpected events disrupt your operations. It ensures that you can continue to pay your fixed expenses, such as rent, utilities, and employee salaries, even if your business is unable to generate income during the interruption. By minimizing financial losses, business interruption insurance helps you recover and resume operations smoothly.

Commercial Auto Insurance: Protecting Your Vehicles

If your appliance repair business relies on vehicles, including vans or trucks, for transportation or service calls, commercial auto insurance is necessary. Here are some key aspects of commercial auto insurance:

Coverage for Business Vehicles and Drivers

Commercial auto insurance provides coverage for your business vehicles and the employees who drive them. It typically includes liability coverage to protect against bodily injury or property damage caused by your employees while driving company vehicles. It can also cover collision damage to your vehicles as well as comprehensive coverage against theft or vandalism.

Protection Against Accidents and Damages

Commercial auto insurance safeguards your business from the financial consequences of accidents or damages involving your vehicles. Whether it’s a minor fender bender or a major collision, the insurance can help cover the costs of repairs or vehicle replacement. It also provides liability coverage in case your employees cause damage to other vehicles or property while driving company vehicles.

Importance of Commercial Auto Insurance for Appliance Repair Businesses

Appliance repair businesses often rely on vehicles to transport equipment, tools, and technicians to customer locations. Accidents can happen at any time, and without proper insurance coverage, your business could face significant financial liabilities. Commercial auto insurance protects your vehicles, drivers, and your business as a whole, allowing you to continue providing reliable service without worrying about potential accidents or damages.

Equipment Breakdown Insurance: Safeguarding Against Equipment Failures

Equipment breakdown insurance is vital for appliance repair businesses that heavily rely on specialized equipment to perform repairs and installations. Here are some important aspects of equipment breakdown insurance:

Coverage for Repair or Replacement of Equipment

Equipment breakdown insurance provides coverage for the repair or replacement of your specialized equipment in case of mechanical or electrical breakdown. This includes your diagnostic tools, testing equipment, and other devices essential for appliance repairs. If your equipment malfunctions due to an unexpected event, such as a power surge or motor failure, the insurance can help cover the necessary repairs or replacement costs.

Protection Against Financial Losses and Business Interruptions

When your equipment breaks down, it can lead to significant financial losses and interruptions to your business operations. Equipment breakdown insurance helps minimize these losses by covering the costs associated with repairing or replacing the damaged equipment. It can also provide coverage for additional expenses, such as temporary rentals or expedited repairs, allowing you to get back up and running as quickly as possible.

Importance of Equipment Breakdown Insurance for Appliance Repair Businesses

Without the proper functioning of your specialized equipment, your ability to provide efficient and reliable service to your customers is severely compromised. Equipment breakdown insurance ensures that you are financially protected in case of unexpected equipment failures. By safeguarding against financial losses and business interruptions, this insurance enables you to maintain your operations smoothly and minimize any potential disruptions.

Conclusion: Protecting Your Appliance Repair Business with Comprehensive Insurance

As an appliance repair business owner or operator, protecting your business from various risks and liabilities is essential for its long-term success. Comprehensive insurance coverage, including general liability insurance, property insurance, professional liability insurance, workers’ compensation insurance, business interruption insurance, commercial auto insurance, and equipment breakdown insurance, offers the necessary protection to safeguard your business assets and mitigate financial losses.

By understanding the importance and benefits of each type of insurance coverage, you can make informed decisions to adequately protect your appliance repair business. With the right insurance policies in place, you can focus on providing exceptional service to your customers and growing your business while having the peace of mind that comes with knowing you are well-insured against unforeseen risks.