Contents

Napa e&o insurance provides reliable coverage and excellent customer service. This comprehensive insurance policy protects professionals against errors and omissions, ensuring peace of mind and financial security.

With customized plans to suit various industries, napa e&o insurance is a top choice for professionals looking for reliable coverage. Whether you’re a real estate agent, consultant, or financial advisor, this insurance company offers tailored solutions at competitive rates. With their responsive customer support and hassle-free claims process, napa e&o insurance is the go-to provider for e&o insurance.

Protect your business and reputation with napa e&o insurance today.

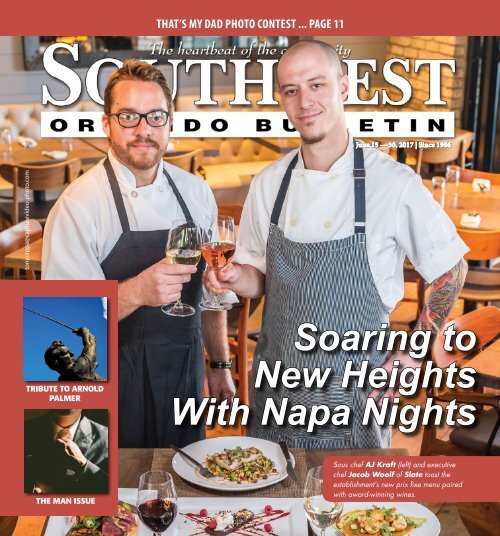

Credit: www.yumpu.com

The Basics Of Napa E&O Insurance

Napa e&o insurance is a vital protection for businesses, safeguarding them against errors and omissions. This type of insurance covers professionals from potential financial loss if they make mistakes or fail to provide promised services. With napa e&o insurance, businesses can confidently operate knowing that they have a safety net to rely on.

It ensures that in the event of a negligence claim from a client, the costs of litigation, settlements, and judgments are covered. This insurance offers peace of mind and helps maintain the reputation and credibility of businesses. Without napa e&o insurance, professionals are exposed to significant financial risks that could severely impact their operations.

By securing this insurance, businesses can focus on delivering quality services while knowing their interests are protected.

Key Features Of Napa E&O Insurance

Napa e&o insurance offers key features that make it a reliable choice for professionals. The coverage details include protection against errors, omissions, and negligence claims. These claims can arise from mistakes in professional advice, services, or failure to deliver promised results.

The insurance also covers legal expenses and court fees. However, it is important to note the limitations of the coverage. Napa e&o insurance may have exclusions, such as intentional wrongdoing or criminal acts. It is crucial to review the policy carefully to understand what is covered and what is not.

Typical claims covered by this insurance include breach of contract, professional negligence, defamation, and copyright infringement. On the other hand, common exclusions may include bodily injury, property damage, and punitive damages. Understanding these aspects is essential to ensure optimal coverage for potential risks.

Why Comprehensive Coverage Matters

Comprehensive coverage is crucial when considering napa e&o insurance. This type of coverage offers extensive protection against various risks and liabilities that businesses may face. When it comes to safeguarding your business, having comprehensive coverage is non-negotiable. It plays a vital role in ensuring that your business is adequately protected from potential lawsuits and financial burdens.

Moreover, comprehensive coverage provides peace of mind, knowing that even in unforeseen circumstances, your business is protected. By exploring the role of comprehensive coverage, businesses can better understand the benefits it brings. Case studies offer real-life examples of how comprehensive coverage has saved businesses from significant financial losses and reputational damage.

Therefore, it is essential for businesses to review their insurance policies and ensure they have comprehensive coverage in place to mitigate potential risks.

Choosing The Right Napa E&O Insurance Provider

Choosing the right napa e&o insurance provider requires evaluating their reputation and financial stability, as well as understanding the policy terms and conditions. It is crucial to ensure that the provider has a strong reputation in the industry and a track record of providing reliable services.

Assessing their financial stability is also essential to ensure they can meet potential claims. Additionally, thoroughly understanding the policy terms and conditions is crucial to avoid any surprises or loopholes in coverage. It is advisable to carefully review the policy documents and ask for clarifications if needed.

By considering these factors, individuals can select a napa e&o insurance provider that offers comprehensive coverage and peace of mind.

Comparing Coverage Options

Comparing coverage options is essential when reviewing napa e&o insurance. Providers offer different levels of coverage with varying inclusions and exclusions in their policies. Assessing these details is crucial to ensure the policy meets your specific needs. Take into account the pricing and deductible options offered by each provider.

Carefully evaluating these factors will help you choose the most suitable plan for your business. Don’t rush in making a decision, as it’s important to have a comprehensive understanding of the coverage options available before finalizing your choice. With thorough research and careful consideration, you can find the ideal napa e&o insurance that provides the necessary coverage and meets your budgetary requirements.

Reporting A Claim

Filing a claim for napa e&o insurance requires certain steps to be followed. You need to gather all the necessary documentation and support for claim submission. This includes any relevant invoices, receipts, contracts, or other evidence. It is important to adhere to the timelines and deadlines for reporting claims, as late submissions may be denied.

Make sure to provide accurate and detailed information about the claim, including the date, time, and individuals involved. Be transparent and honest throughout the process to avoid any complications. By following these steps, you can ensure a smooth and efficient claim filing experience.

Handling The Claims Process

Handling the claims process requires understanding the investigation and evaluation associated with it. Collaborating with insurance adjusters and representatives is essential. Working with them involves negotiating for fair settlements, ensuring equitable outcomes for all parties involved. The investigation phase involves gathering evidence and verifying the validity of the claim.

Evaluations are done to determine the extent of the loss and assess the coverage provided by the policy. Effective negotiation skills can help in securing a fair settlement for the insured. Being knowledgeable about the terms and conditions of the insurance policy is crucial during this process.

By carefully navigating through these steps, both insurance companies and claimants can achieve a satisfactory resolution.

Frequently Asked Questions For Napa E&O Insurance Review

What Does Napa E&O Insurance Cover?

Napa e&o insurance covers errors and omissions in professional services provided by your business. It helps protect you against claims and lawsuits resulting from negligence, mistakes, or omissions in your work.

How Much Does Napa E&O Insurance Cost?

The cost of napa e&o insurance varies based on factors such as your business size, industry, coverage limits, and claims history. It’s best to contact a knowledgeable insurance agent who can provide you with a personalized quote based on your specific needs.

How Do I File A Claim With Napa E&O Insurance?

To file a claim with napa e&o insurance, you should contact your insurance agent or the insurance company directly. They will guide you through the process and provide the necessary forms and documentation requirements.

Why Is Napa E&O Insurance Important For My Business?

Napa e&o insurance is important for your business because it provides financial protection against potential claims and lawsuits resulting from errors or omissions in your professional services. It helps safeguard your business assets and reputation, giving you peace of mind in case of unexpected legal expenses.

Can Napa E&O Insurance Be Customized To My Business Needs?

Yes, napa e&o insurance can be customized to meet the specific needs of your business. You can choose different coverage limits and add-ons to tailor the policy to your industry and risk exposures. Consulting with an insurance professional can help ensure you have the right coverage in place.

Conclusion

Napa e&o insurance has proven to be a reliable and trustworthy insurance provider for businesses in need of errors and omissions coverage. With their comprehensive policies and customizable options, they offer peace of mind to professionals in various industries. Their experienced team is dedicated to understanding the unique needs of each client and providing personalized solutions.

Napa’s responsive customer service and quick claims process ensure that businesses can rely on a seamless experience and prompt resolution in the event of a claim. By choosing napa e&o insurance, professionals can protect their assets and reputation while focusing on delivering exceptional services to their clients.

Don’t risk the financial and legal implications of errors and omissions – choose napa e&o insurance for comprehensive coverage and peace of mind. Get a quote today and safeguard your business against potential risks and liabilities.